A Breakdown Of the US-CHINA Tariff War. XI Vrs Trump : Who Wins?

- C MONEY

- Apr 13, 2025

- 4 min read

This week, global markets were shaken by a major escalation in the US-China trade war. In response to new US tariffs, China has retaliated with a stunning 84% tariff on certain goods. While this move grabbed headlines, the real storm may be brewing elsewhere—in the bond market, which is flashing some of the most serious warning signals we’ve seen in decades. 📉 A Quick Shift from Stocks to Bonds

Whenever global tensions rise, investors tend to move away from riskier assets like stocks and into perceived “safe havens” like US Treasury bonds. That’s exactly what happened late last week: investors dumped stocks and poured cash into bonds, pushing demand up and yields down.

But that sentiment reversed incredibly fast.

Within just a few days, bond yields surged, signaling a wave of selling pressure. For example:

The 30-year Treasury yield saw its sharpest rise in over 40 years.

The 10-year Treasury yield jumped at its fastest pace since the 2008 financial crisis.

These are not small moves. Yields on US government bonds—an asset class known for its stability—rarely move this dramatically unless something serious is going on.

When bond yields rise, it’s usually a sign that bond prices are falling—meaning investors are selling.

For Consumers:

Higher yields directly impact everyday borrowing. Since many interest rates (like 30-year mortgages, auto loans, and credit cards) are tied to US bond yields, this means:

More expensive loans

Higher monthly payments

Tighter access to credit

For the US Government:

Things are even more serious on the federal level. Between now and the end of the year, the Treasury Department needs to:

Refinance over $8 trillion in maturing government debt

Borrow another $2 trillion to cover this year’s budget deficit

Rising yields mean it will cost hundreds of billions of dollars more just to pay interest. That makes an already difficult fiscal situation even worse. 🔍 What’s Causing Yields to Rise So Quickly?

There’s really only one explanation: a massive imbalance in supply and demand.

Too many investors are dumping US bonds, and there aren’t enough buyers stepping in to absorb the excess supply. This kind of sell-off could be driven by:

Major Wall Street firms losing confidence in current fiscal or trade policies

Foreign governments, like China, reducing their holdings of US debt

Bond vigilantes—a term for investors who punish governments for poor economic decisions by selling off their bonds

If any (or all) of these players are intentionally dumping US Treasuries, it could explain the sudden surge in yields. 🌍 A Global Example: The UK in 2022

This situation echoes what happened in the UK in September 2022. Then–Prime Minister Liz Truss announced an economic plan that included large tax cuts. Bond investors feared it would blow up the deficit, so they dumped UK government bonds (gilts), causing yields to spike and the British pound to collapse.

The Bank of England had to step in to stabilize markets.

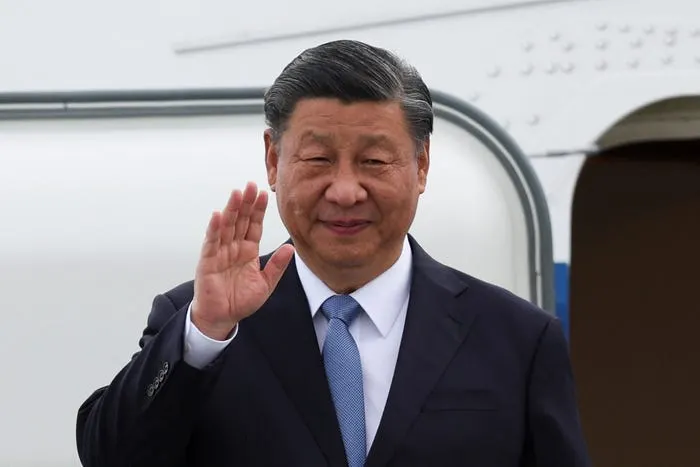

The US may now be facing similar pressure from global investors questioning its economic trajectory. 🇨🇳 China’s Strategic Play?

One of the biggest holders of US debt is China, with over $1 trillion in Treasury securities. If China is now reducing its exposure to US bonds in retaliation for the trade war, it could cause far more economic pain than tariffs alone.

In essence, China could be weaponizing its bond holdings. 🪙 The Gold Rush

During the initial market panic, even gold was sold off. But it has since roared back, surging toward record highs.

Why?

Gold is a traditional safe haven in times of uncertainty.

It’s not tied to any government, making it a neutral store of value.

Central banks and foreign governments are buying gold to reduce their reliance on the US dollar.

Even more interesting: Gold mining companies, which had remained undervalued for months, are finally surging alongside the metal itself. That could signal a broader shift in investor sentiment. 🔁 A Global Financial Reset?

All of this points to a potential reset in the global financial system:

The US dollar’s role as the world’s reserve currency is being questioned.

Central banks are diversifying into gold and other currencies.

Emerging powers like the BRICS nations are exploring alternatives to the US-led monetary order.

In such a scenario, gold—and gold-related assets—could play a much more central role in the future of finance. 🧠 Is This All Part of a Strategy?

Some analysts speculate that this chaos might be a deliberate move by the Trump administration—a high-stakes gamble to force a global economic realignment and bring leverage back to the US.

If true, it’s one of the boldest economic plays in recent memory. But make no mistake—it’s also incredibly risky. 🚨 Final Thoughts

Here’s what we know for sure:

The US-China trade war is escalating.

The bond market is experiencing historic volatility.

Rising yields are sending a clear message: investor confidence is slipping.

Gold is surging, and with it, signs of a broader financial reset are emerging.

Whether you’re an investor, business owner, or simply watching the news, this is a critical moment. The coming weeks and months could reshape the global financial system as we know it.

Comments